April 25, 2024

Nickel price drop is a boon for stainless steel and battery electric vehicle makers

Growing nickel production fuels supply and lowers prices, which hurts miners but helps sectors that use the metal as a raw material.

Growing nickel production fuels supply and lowers prices, which hurts miners but helps sectors that use the metal as a raw material.

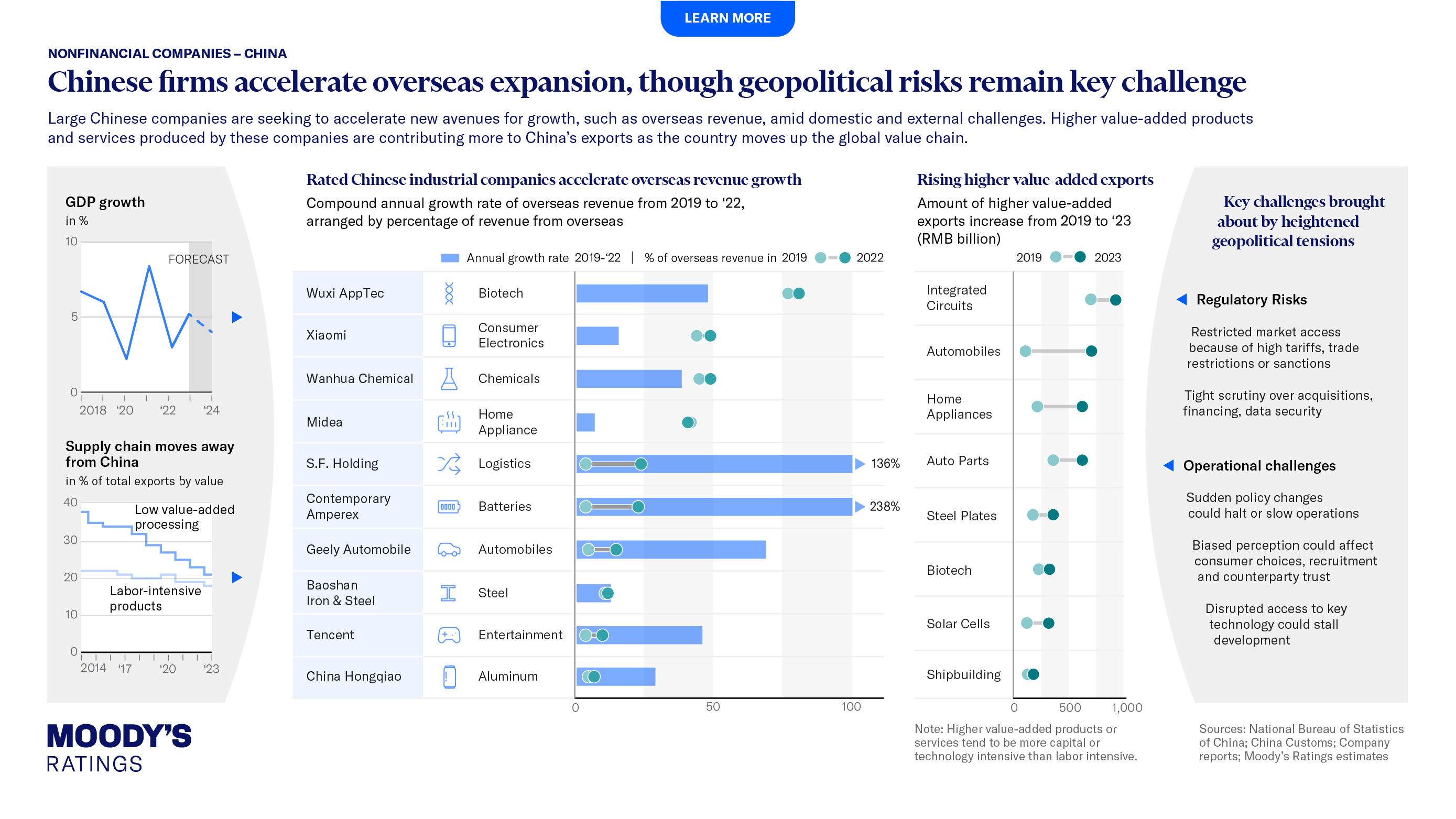

Higher value-added products and services produced by Chinese companies are making a greater contribution to exports as the country moves up the global value chain.

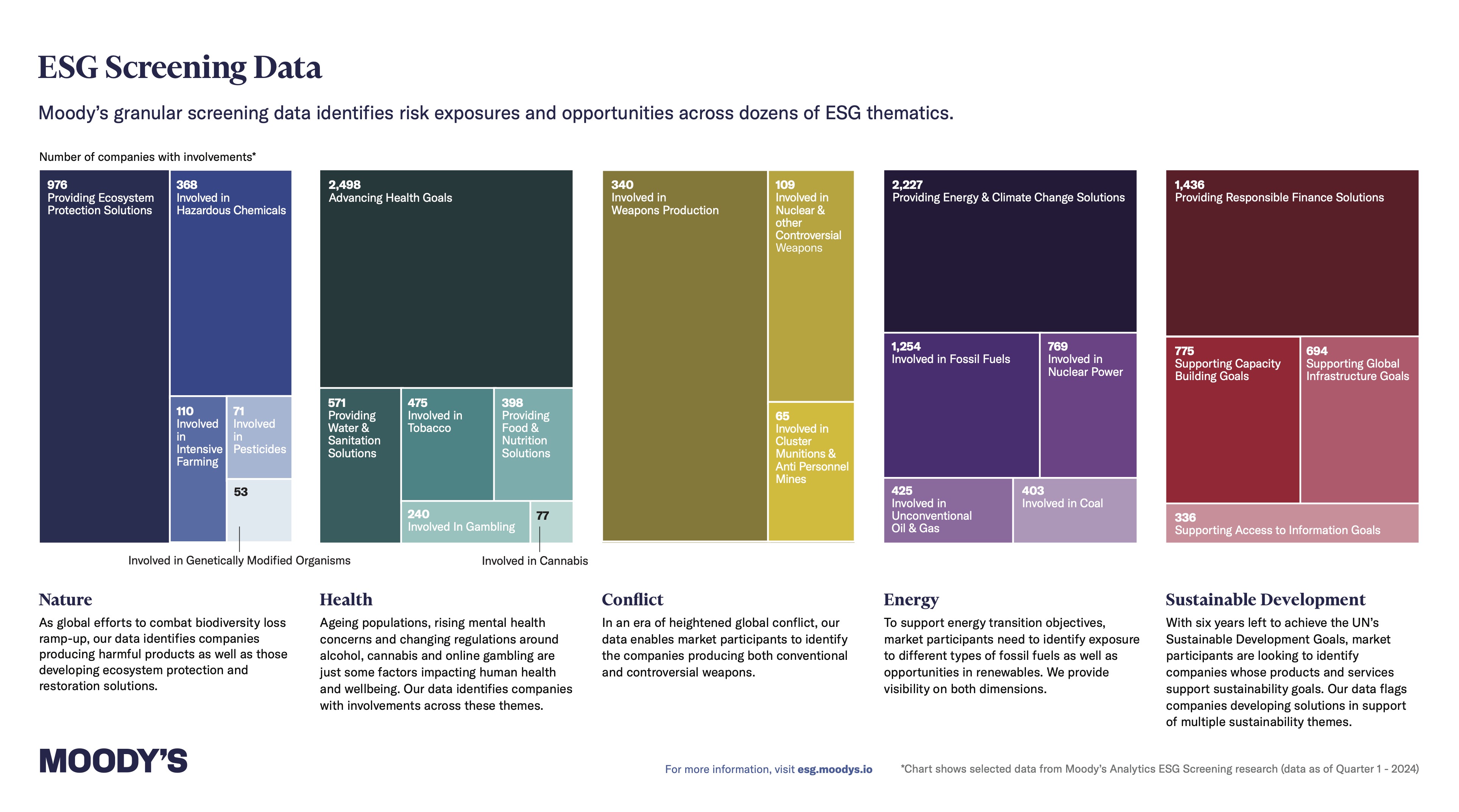

Moody’s granular screening data identifies risk exposures and opportunities across dozens of ESG thematics.

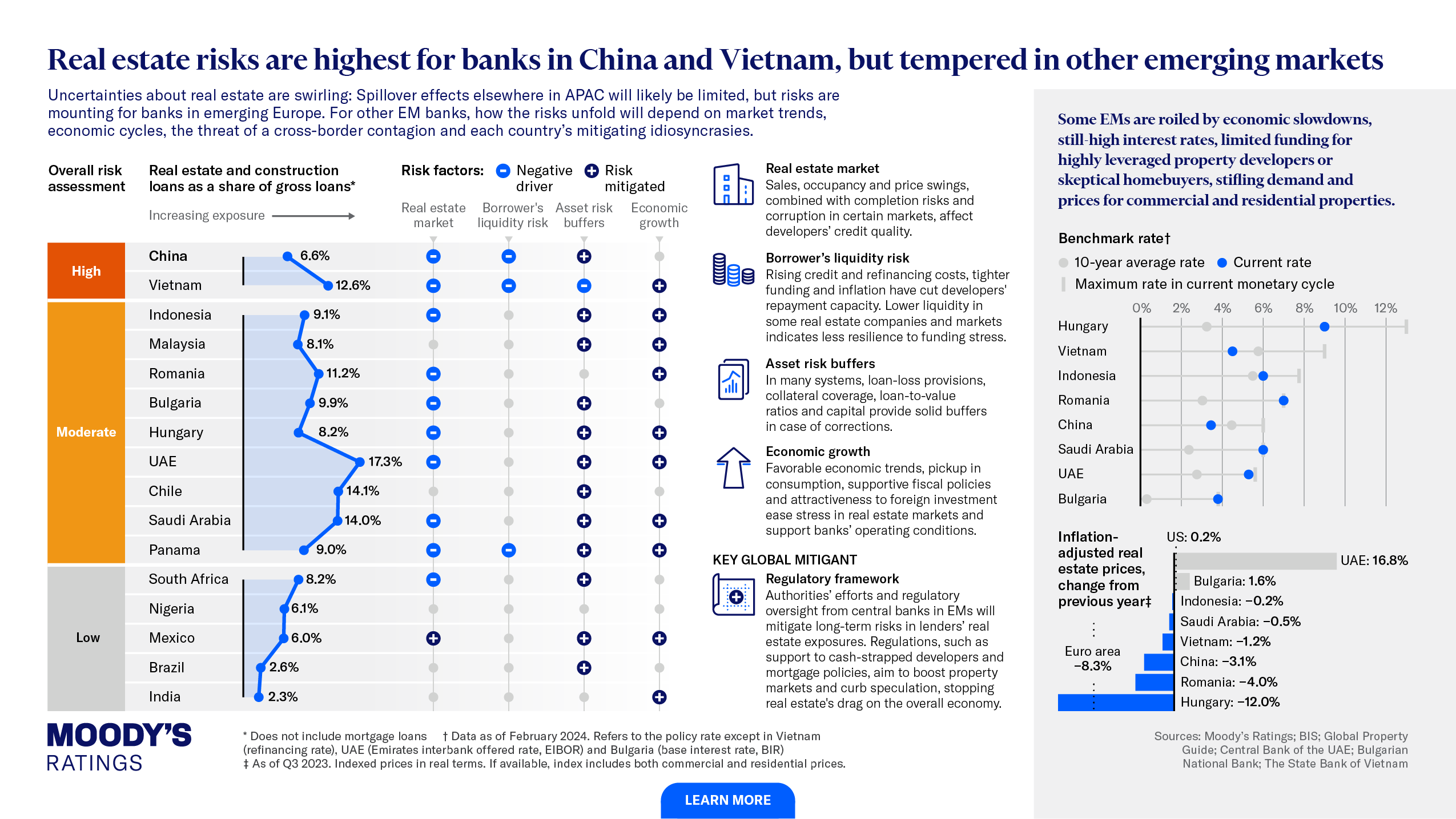

Spillover effects elsewhere in APAC will likely be limited, but concerns are mounting in emerging Europe. How the risks unfold will depend on each country’s mitigating idiosyncrasies.

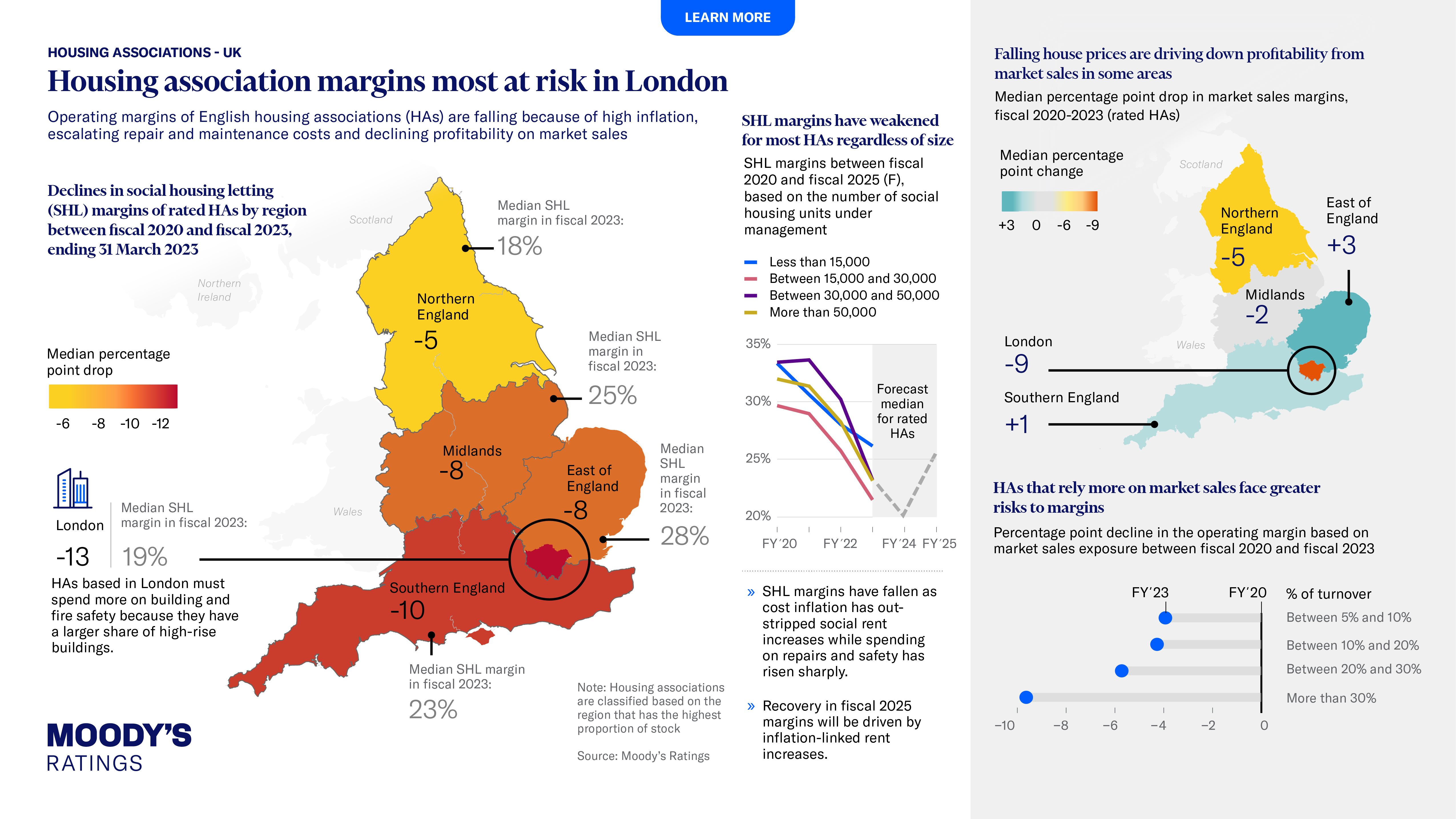

Operating margins of English housing associations (HAs) are falling because of high inflation, escalating repair and maintenance costs and declining profitability on market sales.

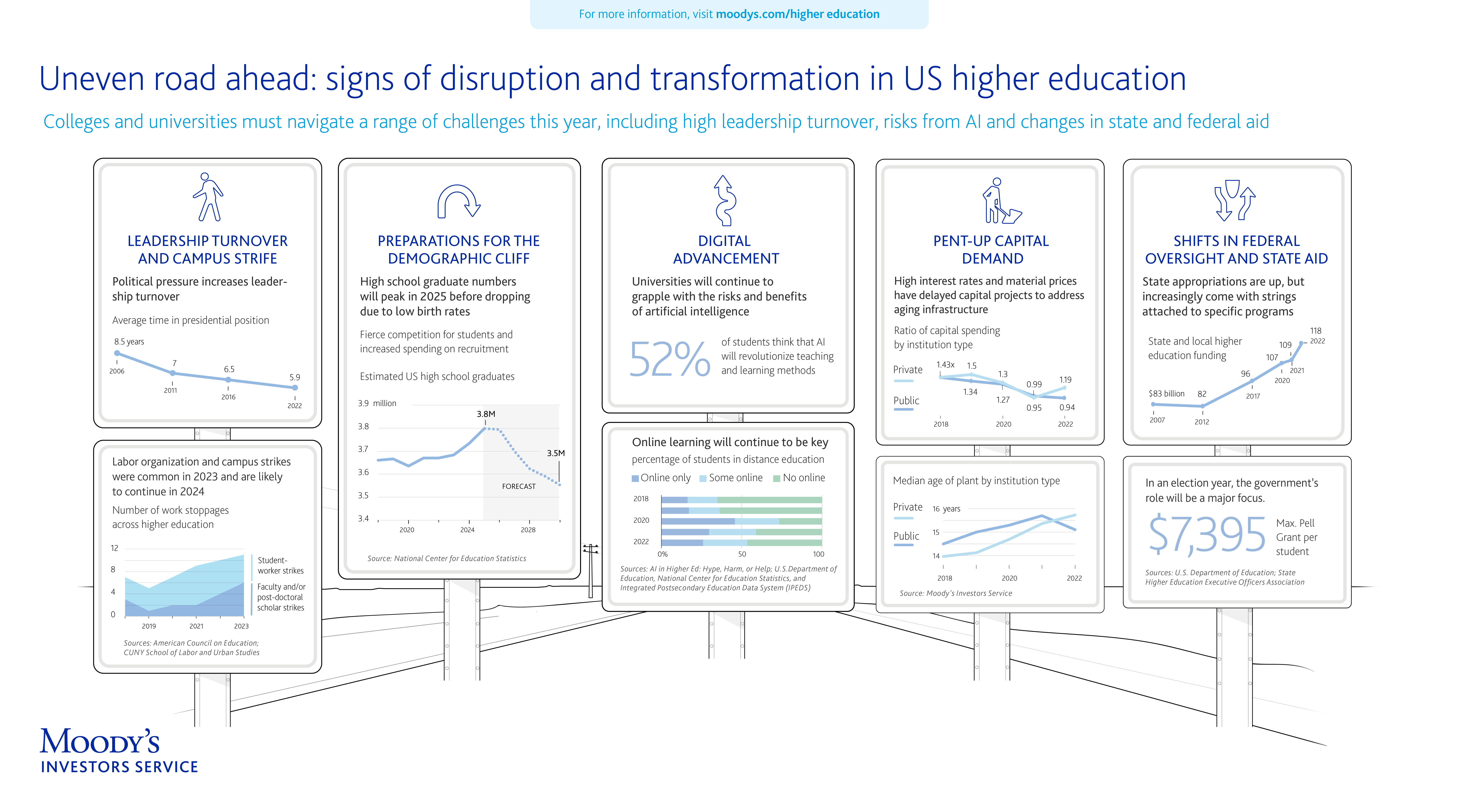

Colleges and universities must navigate a range of challenges this year, including high leadership turnover, risks from AI and changes in state and federal aid.

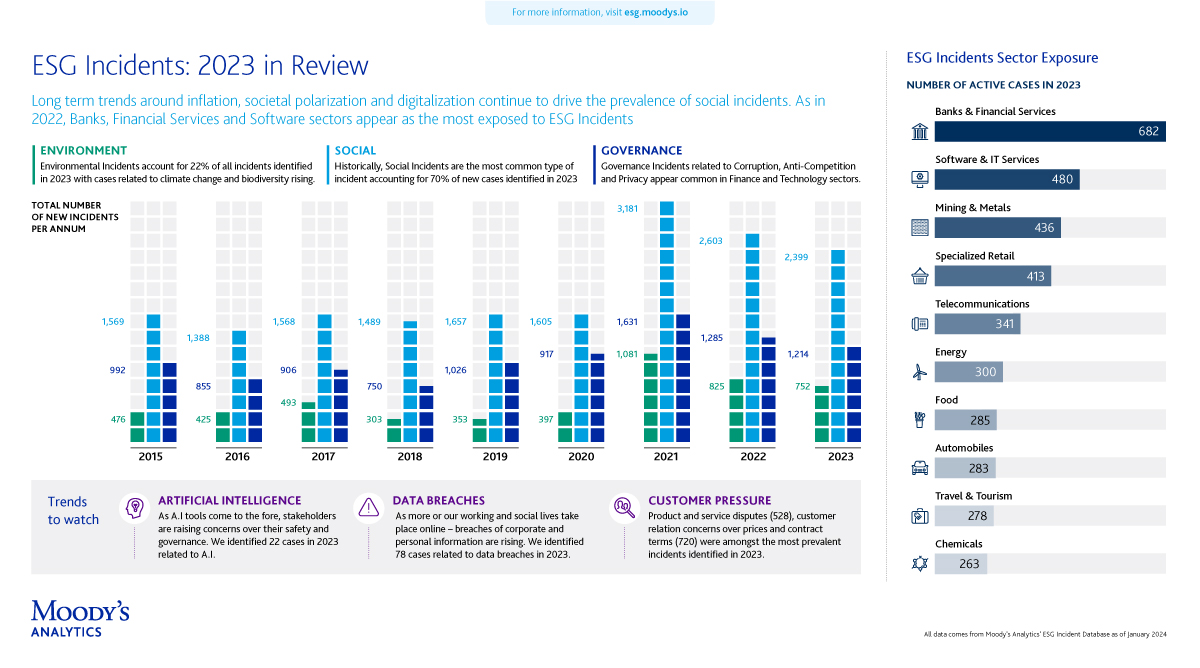

Long term trends around inflation, societal polarization and digitalization continue to drive the prevalence of social incidents. As in 2022, Banks, Financial Services and Software sectors appear as the most exposed to ESG Incidents

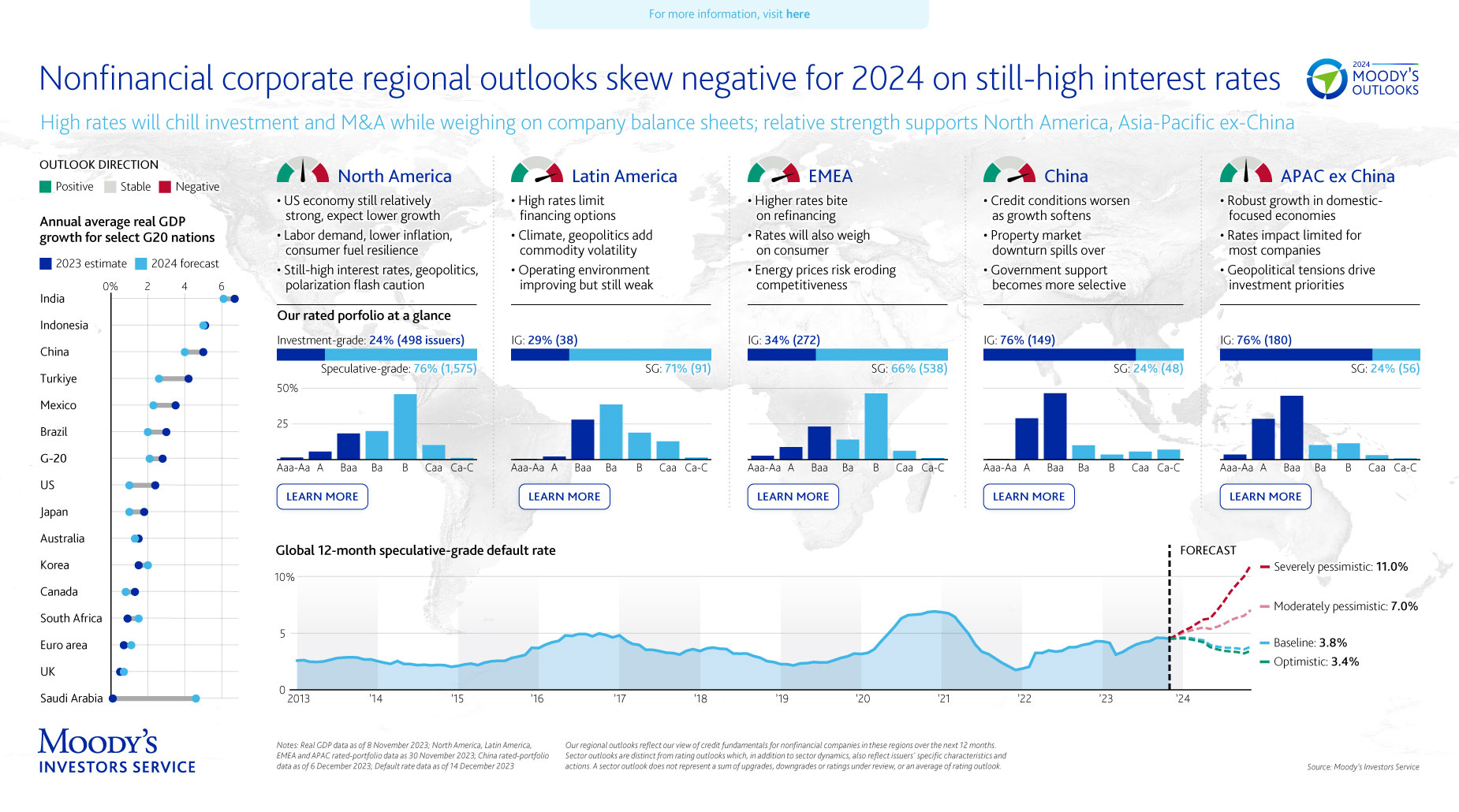

High rates will chill investment and M&A while weighing on company balance sheets; relative strength supports North America, Asia-Pacific ex-China

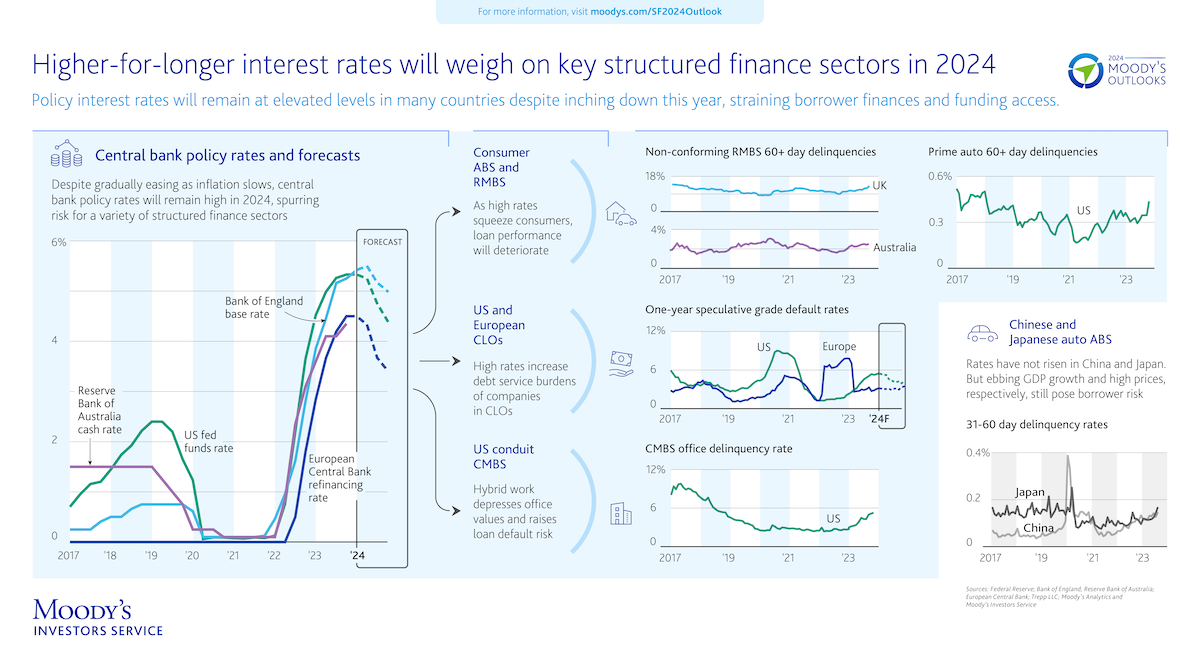

Policy interest rates will remain at elevated levels in many countries despite inching down next year, straining borrower finances and funding access

Weak sentiment will strain sectors already facing difficulty like property, causing spillover effects to other industries. Slower global growth and geopolitical tensions add to challenges.