April 8, 2024

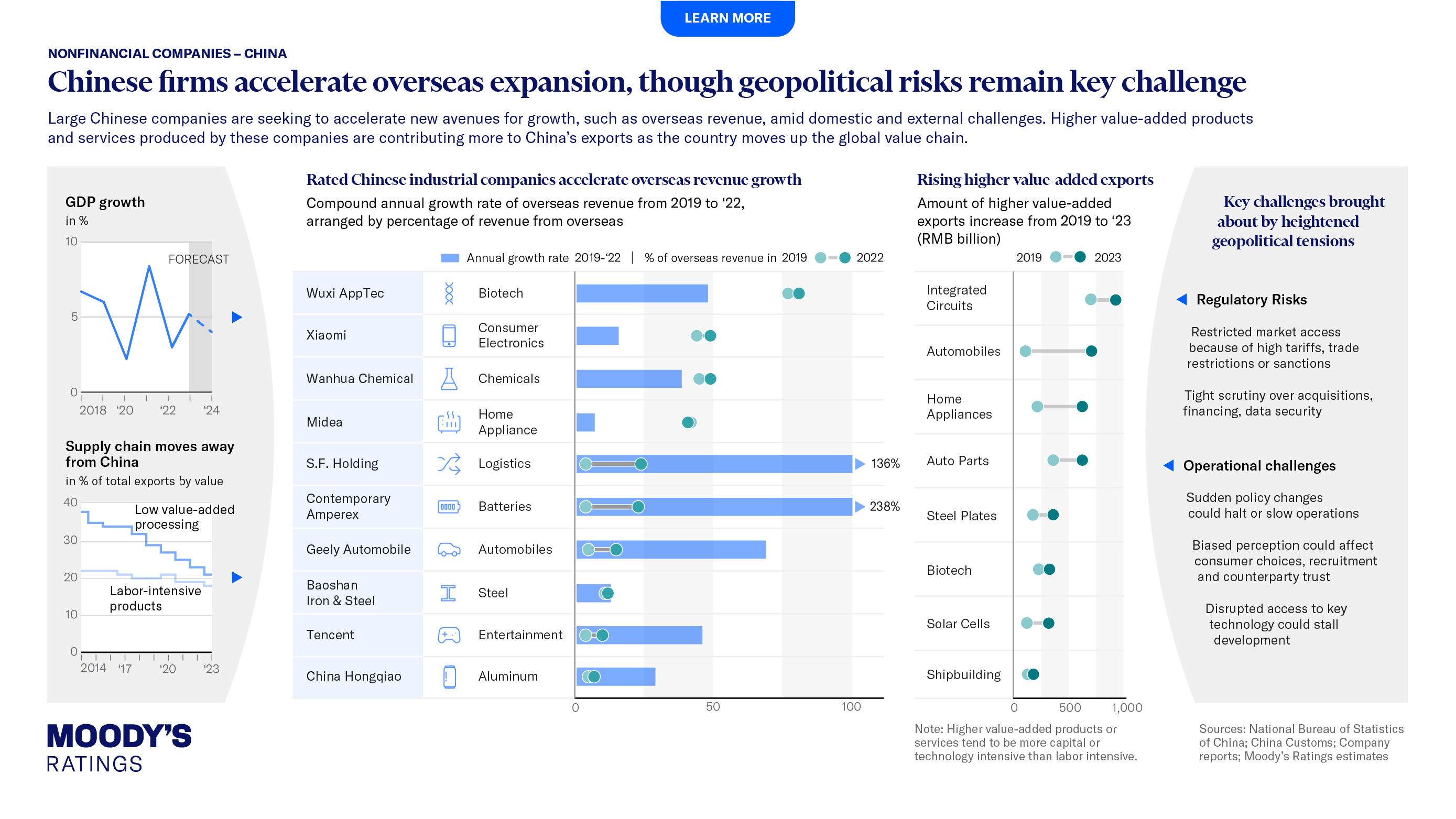

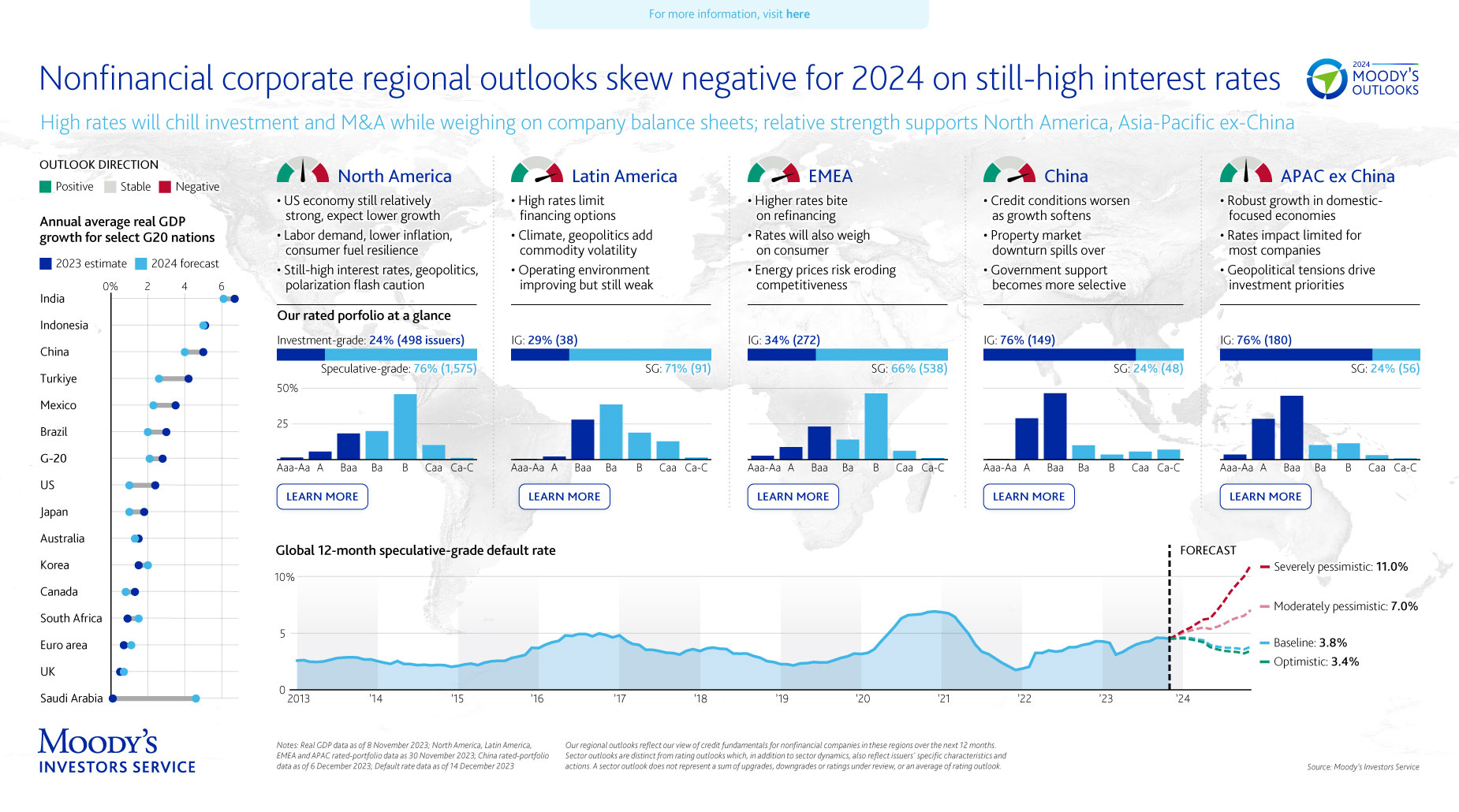

Chinese firms speed up their overseas expansion but geopolitical tensions are a key hurdle

Higher value-added products and services produced by Chinese companies are making a greater contribution to exports as the country moves up the global value chain.